|

COLUMNS |

| Legal Management |

Valuation of Intellectual Property

Background

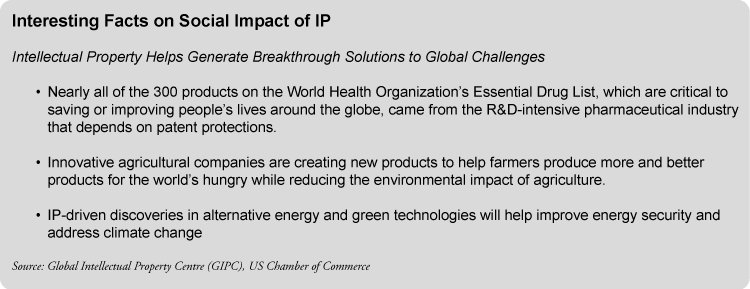

In this knowledge driven era, intellectual property (“IP”) is being increasingly recognised as the engine for economic growth. Asia, being a center stage driving global growth, has taken full advantage in focusing on IP-driven businesses, be they technology, healthcare or consumer goods. Statistics around IP filings, IP asset transfers, royalty and licensing fees, IP disputes, etc clearly demonstrate the increasing need to understand the monetisation aspects of intellectual property. The link between technical development of IP and its ultimate commercialisation largely hinges around economic viability factors. Valuation exactly deals with this aspect. It acts as a key decision-making tool in financing, development and commercialisation of IP. We see valuation playing a critical role in providing impetus to the goals set out by the Government of Singapore in its IP Hub Master Plan.

With this background, we endeavour to provide to the reader some of the key aspects of valuing IP. We aim to cover the critical properties of IP that act as “value enablers” and demonstrate how different methodologies for valuation of IP are adopted in various circumstances.

Introduction: IP Metamorphosis

Intellectual property has been in existence for several centuries, in the form of secret formulations in Chinese/Indian medicine during the ancient era to mobile-based technology in the modern age. It has been a contentious issue over many centuries, particularly because it allows businesses to establish economic dominance. The science behind commercialisation of IP has evolved over many centuries. In order to protect commercial/strategic interests, IPs were always safeguarded and only passed by word of mouth from generation to generation. As the world became globalised, the importance of legal frameworks came to fore in order to protect the owners’ commercial interests in their IP.

The use and applicability of IP has evolved significantly over the years, from a primary focus on defensive competitive behaviour (eg creating entry barriers for competitors and enforcing patent laws against infringers) to being core to business strategy (eg licensing and building a patent portfolio), and an important financial asset (ie attracting external sources of finance). Given the important commercial utility of IP, it becomes imperative to understand the value it generates; consequently, the role of valuation specialist gathers importance.

Why Value IP?

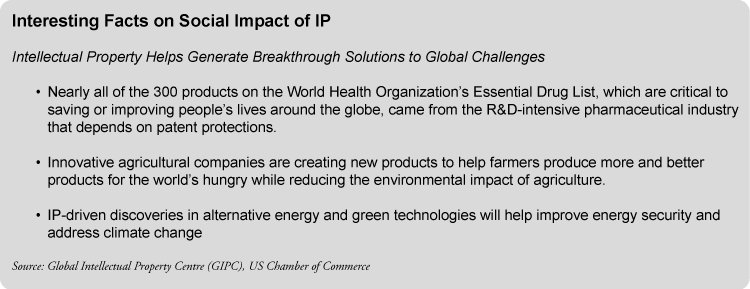

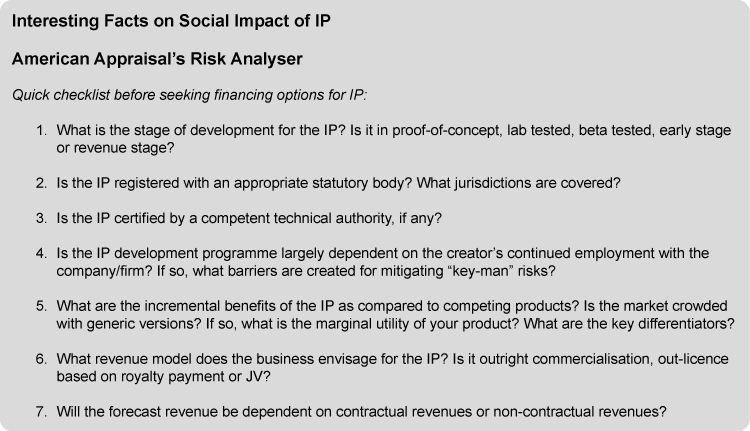

Valuation of IP may be required for a variety of reasons; different stakeholders have different interests in IP.

Although common perceptions of IP valuation are often based on capitalisation of development costs, the real significance has increased for a variety of purposes, including financial reporting, acquisitions, investor relations, licensing and franchising, securitised borrowing/financing, equity fund raising, litigation issues, tax planning and transfer pricing, and for internal management evaluation of performance of IP.

First Principles for Valuing IP

There are various methods to value IP. Different circumstances require different approaches. The most prudent valuer would use a variety of methods to compare and contrast the valuation output before concluding on a range of values. This process becomes highly subjective, and a great degree of professional judgment is applied before considering the results from each methodology. Hence, an in-depth understanding of the IP and experience in IP valuation becomes critical.

Valuation methodologies can be broadly classified under the following:

A. Cost Approaches

The cost approach is based on the cost of obtaining a patented invention by either internal development or external purchase. All cost based valuation methods are based on the principle of substitution. Replacement cost represents what it would cost today to buy a substitute intangible asset of comparable utility if the same is available in the market. The replacement cost method is especially useful for purchased intangibles such as off-the-shelf software and similar licences. The cost of the new substitute intangible asset should be adjusted for obsolescence factors in order to make the hypothetical new intangible asset comparable to the subject intangible asset.

Challenges

It is usually inappropriate to use the cost approach as it fails to capture the future earnings potential of the IP. It may be used as a cross check or second method to check the reasonableness of value established by the primary method. It may also be used to value IP-related assets to assist in buying decisions for assets with a relatively short history, where it is not practical to use other methods.

B. Market Approaches

The market approach determines the value of an IP by comparing the price paid by other market participants for reasonably similar assets.

Market transactions method

The market transactions method is used to estimate the fair value of an asset by reference to the transaction prices or valuation multiples implicit in the transaction prices of identical or similar assets in the market.

Challenges

IPs are rarely sold in piecemeal transactions, and it usually is difficult to find comparable transactions. Furthermore, since intangible assets are unique to a particular business entity, comparison between entities would be difficult; hence, this method is rarely used in practice, except in certain cases.

C. Income Approaches

The income approach attempts to calculate the present value of the projected future cash flow arising from the subject IP during its economic life. Key methods under this approach include:

Relief-from-royalty method

The relief-from-royalty method values the IP by reference to the amount of royalty one would have had to pay in an arm’s length licensing arrangement to secure access to the same rights. The key inputs into this method are the “royalty rate”, which is then applied to the revenue projection to estimate the amount of theoretical royalty payments. This royalty stream, which the owner does not have to pay since the intangible asset is already owned, is then taxed and discounted back to present value.

Multi-period excess earnings method (“MEEM”)

The MEEM is applied to a wide variety of intellectual assets, especially those that are close to the “core” of the business model (sometimes referred to as “primary” or “leading” assets). In practice, IP is frequently valued using the MEEM.

Since the IP being valued generates after-tax operating income by using contributory assets, in order to estimate the earnings that are solely attributable to the asset being valued, an economic rent for the use of other contributory assets is deducted from the operating income. These cash flows are then discounted after adjustment for the required rate of return.

Other Methods

Some of the other methods taken into consideration under income approach methods are:

1. Premium pricing method: premium over generic product prices of products or services that do not possess the intangible being valued.

2. Avoided cost method: after-tax costs saved by owning the asset; applied to favourable contracts and workforce.

3. Option-based: Early-stage IP developments can be, and in most cases should be, used for valuation, especially when certain IPs in their early stage have a high degree of path dependence. For example, some early stage molecules in biotechnology have to go through stages of clinical trials and regulatory approvals prior to commercialisation. Option-based models equip the valuer to determine the factors for such path-dependent variables, and a range of values can be established using various option models.

4. There are other methods such as earnings split, economic use, etc, which are derived from one or more of the above approaches

Challenges

The greatest challenges to any income method are the estimation of revenues, the discount rate and useful life of the IP. Longevity of IP is largely dependent on various factors such as technological obsolescence, attrition in revenue, product life cycle, ability of the IP to adapt to changing market conditions, etc. These factors are more often than not subjective, and the experience of valuation specialists will be required to assess such inputs.

One of the key aspects to be aware of is the comparability of licensing transactions to estimate the royalty rate. The valuer should also be able to compare and contrast the profitability and growth factors between the subject IP and the IP being used to benchmark the royalty rates. Some transactions also have upfront and milestone payments along with royalty payment; such nuances must be considered before arriving at the comparable royalty rate applicable to the subject IP.

In early-stage IPs, projecting future cash flows becomes a challenge at times. Despite the above challenges, the income method is the most popular and widely used method due to its practical application.

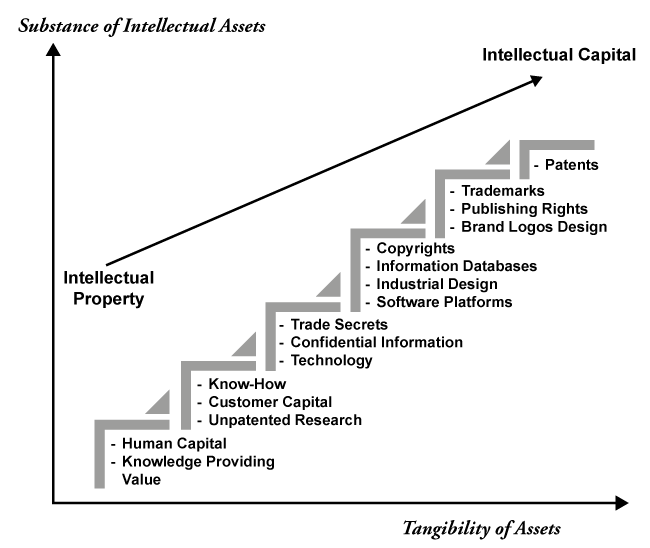

IP Maturity Matrix

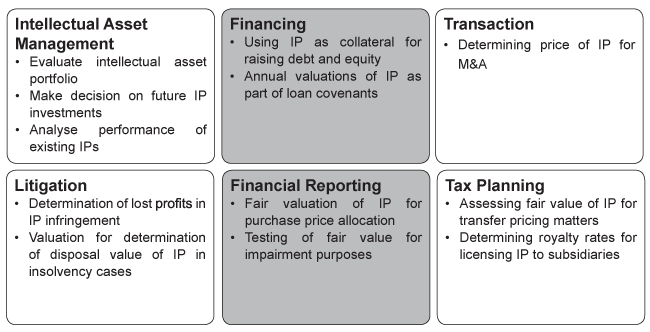

As tangible factors such as commercial feasibility, legal protection, and the marketing of the IP become further developed, the perceived risks decrease. In most cases, mature IP can more easily attract additional investments either in the form of additional rounds of raised capital or perhaps as the target of an acquisition.

Making the Right Choice

Selecting an appropriate methodology for the situation at hand is a critical aspect of the valuation process, the relative emphasis of each method often varying with the factors such as stage of development of the IP, feasibility of the IP, adequacy of comparable transactions in the market, the utility of the IP from enhanced legal protection, etc. In addition to choosing a method for valuing the subject IP, the valuer must try to cross-check the results from one approach to another. Testing sensitivities to the output based on various inputs is an imperative step in valuation.

As a cornerstone principle of valuation, the value of the IP increases with its ability to generate higher profits; however, profitability has to be considered along with specific risks associated with the asset, its marketability and its synergy with various other business functions. It would be prudent to entrust valuation of such intellectual property and other intangible assets to valuation experts who would be better equipped in appropriately identifying and quantifying such risks.

► Srividya C.Gopalakrishnan

Managing Director, Americal Appraisal*

E-mail: [email protected]

► Karthik Balisagar

Vice President, Americal Appraisal*

E-mail: [email protected]

*American Appraisal is a valuation and advisory firm established in 1896 in North America and has strong presence in North America, Europe, the Middle East, Asia-Pacific and South America. We have approximately 900 employees worldwide, located in more than 50 offices across 24 countries.

www.american-appraisal.sg

Disclaimer: The information contained herein is of a general nature, non-comprehensive and not intended to address the circumstances of any particular individual or entity.